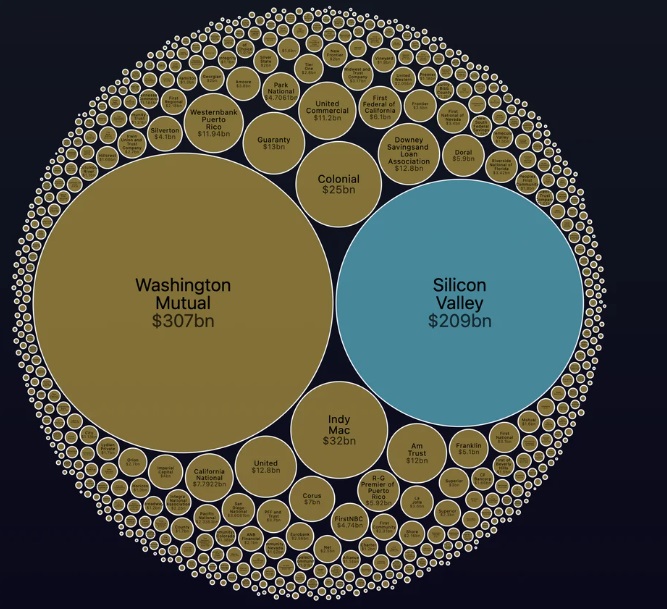

Viral Chart Showing Size of Bank Failures Since 2000 Puts in Perspective How Big the Silicon Valley Bank Crash Is

A viral chart showing the size of bank failures since 2000 puts in perspective how the recent collapse of Silicon Valley Bank (SVB) is the biggest banking disaster since Washington Mutual’s $307 billion failure in 2008. The chart, which was widely shared on social media, shows how all the other bank failures in the past two decades pale in comparison to SVB’s $209 billion crash.

The chart shows how SVB’s failure dwarfs other notable bank collapses such as IndyMac ($32 billion), Countrywide ($21 billion) and Lehman Brothers ($19 billion). The chart does not include non-bank financial institutions such as Bear Stearns or AIG, which also received government bailouts during the 2008 financial crisis.

SVB was a major lender to tech companies and startups, with clients such as Roku, Roblox, Rocket Lab and many others. The bank suffered a run on deposits after it failed to raise enough capital to meet regulatory requirements. On March 10, 2023, California regulators closed down SVB and put it under the control of the US Federal Deposit Insurance Corporation (FDIC), which is expected to sell off its assets and liabilities to other banks.

Is Roku Shutting Down Due to the Silicon Valley Bank Crash

One of the most affected companies by SVB’s collapse is Roku, a streaming device maker that had $487 million of its cash held at SVB, which represents 26% of its total cash and equivalents. Roku disclosed this information in a filing with the Securities and Exchange Commission (SEC) on March 10. Roku said it does not expect to recover any of its funds from SVB and that it may face liquidity issues as a result.

Roku also said it may be unable to pay its vendors, suppliers, employees and other obligations due to SVB’s failure. This could have a severe impact on Roku’s operations and financial performance. Some analysts have speculated that Roku may be forced to shut down or file for bankruptcy protection if it cannot find alternative sources of funding.

Other tech companies that had significant deposits at SVB include Roblox ($100 million), Rocket Lab ($70 million) and Affirm ($50 million). These companies also said they do not expect to recover their funds from SVB and that they are evaluating their options. The FDIC has said it will try to minimize disruptions for SVB’s customers and creditors, but it has not given any details on how much money they can expect to get back.

Will FDIC’s Deposit Insurance Fund Be Affected?

The FDIC has also said that SVB’s failure will not affect its deposit insurance fund, which covers up to $250,000 per depositor per insured bank. However, some experts have questioned whether the FDIC has enough resources to handle such a large bank failure amid rising interest rates and inflation pressures. The FDIC has not disclosed how much it expects to lose from SVB’s collapse.

The Silicon Valley Bank crash is a stark reminder of the risks involved in banking and lending, especially in volatile sectors such as technology. The viral chart showing the size of bank failures since 2000 illustrates how rare and devastating such events can be for both customers and shareholders.

Explore Related Articles

Conservatives Destroy Lebron James For Mocking Kyle Rittenhouse Crying on the...

Lebron James is one of the most outspoken athletes in NBA history. When something is happening that involves culture, he isn't afraid to state his opinion. Often times his statements are met with much backlash from the republican leaning individuals, and the trend continues with Lebron's comments about Kyle Rittenhouse...

Is Balenciaga Going Out of Business? Video of 50% Half Off...

Recently Balenciaga came under major scrutiny after they posted campaign ads on Instagram that had some very strange vibes going on. Firstly there was a small child holding a teddy bear in bondage gear. Secondly on the table in the picture were court documents related to a pedophile trial....

8 Year Old Boy Arrested for Allegedly Slicing Throat of Foster...

Foster care is a system that provides temporary care for children who have been abused, neglected, or abandoned by their parents or guardians. The goal of foster care is to protect children from harm and provide them with a safe, stable, and nurturing environment until they can be reunited...