Tax Professional Patrice Stewart Explains How FEDS are Catching PPP Fraud and Sending People to Jail at High Rates

With the government going into overdrive on cracking down on fraudulent PPP loans many people are finding themselves facing jailtime. The main reason being is that the most people who filed these fraudulent PPP loans had no idea about the true paperwork and documentation that went into securing the money through loan companies. To clarify the situation for people a tax professional named Patrice Stewart explained how FEDS are catching PPP fraud, and sending people to jail at higher raters than ever before in recent weeks.

Patrice Stewart makes many good points in the 37 minute video below, but we have highlighted some of the most pertinent talking points from the video into a list. We still urge you to watch the full video after reading through the list below, but here are some of main reasons Tax professional Patrice Stewart said people are going to jail for PPP fraud.

- If you filed PPP prior the February 21, and you don’t have real business on your Tax return there is a high chance FEDS are coming for you.

- Many people who filed PPP loans last year didn’t check the paper work loan companies were putting in for them. Loan companies were required by law to list that your business fake or real was making at least $100,000 in net income to get approval for a $20,000 PPP loan. FEDS are easily able to see that you didn’t really make that amount in net income when you have to file taxes, but many people didn’t even know their fake business was listed as making $100K net income.

- When submitting a PPP application loan companies had to also submit a legal tax documentation in the form of a Schedule C form, which is filed alongside a 1040 form during Tax time. This is another easy way FEDS are catching PPP fraud, since they can also detect if you don’t file that Schedule C form.

- If you are on disability, Section 8, or any type of government assistance and put in a PPP application the government will easily be able to detect fraud due to a new linkage system that connects all government assistance program networks. Many people who got fraudulent PPP loans were already on government assistance so the FEDS are already on to them even if they don’t know it yet.

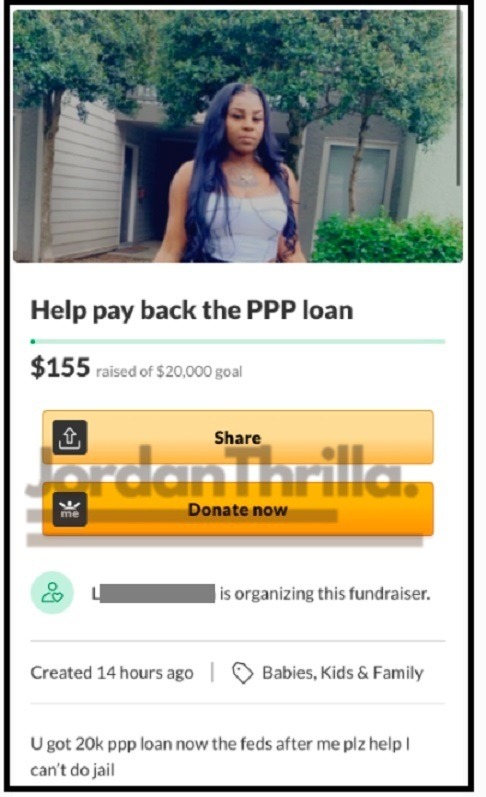

If you go on GoFundMe you can see many people asking for donations to help payback fraudulent PPP loans after the FEDS had caught on to them. Below is a picture of one example, and you can see many more in our article about PPP fraud GoFundMe campaigns here.

Long story short is if you got a fraudulent PPP loan, it’s only a matter of time before the FEDS come knocking at your door.

Author: JordanThrilla Staff

Explore Related Articles

Does P Diddy Urinate on Yung Miami? ‘Pee Diddy’ Trends After...

Does P Diddy piss on Yung Miami? Rumors have been swirling that P Diddy has been urinating on Yung Miami, because the rapper recently admitted that she enjoys golden showers on 'Caresha Please'. This has caused the name "Pee Diddy" to trend on Black Twitter and other social media,...

New Details on How and Why Chadwick Boseman’s Manager Chris Huvane...

It's been about one week since the world learned the tragic news about Chadwick Boseman's manager Chris Huvane. Back on February 6 it was reported that Chris Huvane is dead, but details surrounding his exact cause of death weren't known until now. New details have revealed how Chris Huvane...

Burger King Karen Tells Sudanese Woman Named Lala Her Burger King...

What would you do if you were on the job wearing a completely normal work uniform, and customer complained it was inappropriate? In the case of one biochemistry student, she went to TikTok to make sure her story was heard by the world. The incident involved a Burger King...